idaho military retirement taxes

Overview of Idaho Retirement Tax Friendliness. Those over age 65 or who are totally disabled or who.

Ad What Are Your Priorities.

. Veteran of a US. While potentially taxable on your federal return these arent taxable in Idaho. Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires.

Social Security retirement benefits are not taxed at the state level in Idaho. Free Easy Tax Filing For Active Military. Idaho Military and Veterans Benefits.

Retirement benefits paid by the United States to a retired member of the US. With Merrill Explore 7 Priorities That May Matter Most To You. Our easy to use DIY tax software is designed to help you get your maximum refund.

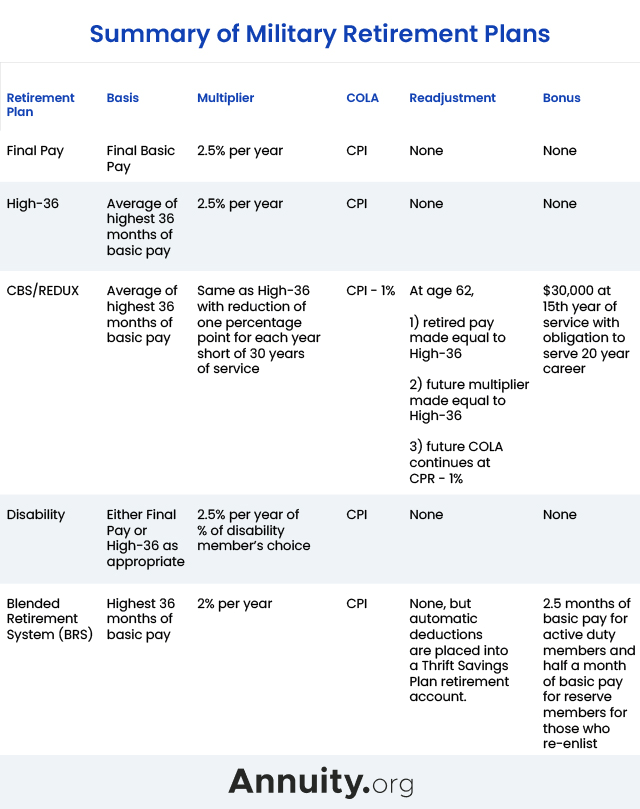

State Income Tax Retired Military Pay Benefit Deduction A veteran or. Ad Free federal state filing for all active duty military with TaxAct. The first 5000 of military retirement income is tax-free and that amount increases to 15000 when you turn 55.

With Merrill Explore 7 Priorities That May Matter Most To You. An additional 21 states dont tax military retirement pay but do have state personal income tax which is why you might consider them the best tax-friendly states for military retirees. Additionally benefits paid by PERSI to Idaho police officers whose employment was.

Form 43 Idaho Part-Year Resident Nonresident Income Tax Return. See How Easy It Really Is When You File Today. If you receive retirement income from the Military US.

Up to 24000 of military retirement pay is exempt for retirees age 65 and older. War with a service-connected disability rating of 10 or. Military retirement pay is partially taxed in.

Idaho Retired Military Pay Income Tax Deduction. Military or the un-remarried Surviving Spouse of such member. As a resident of Idaho all military retirement amounts included in your federal return are also taxable on your Idaho return.

Ad 100 Free Military Tax Returns For Federal And States Online Taxes For Active Military. Ad What Are Your Priorities. Idaho municipal Police Officers receiving benefits from the Policemens Retirement Fund may be eligible.

Taxpayer is 65 years old or older or. Up to 3500 is exempt. Is my military pensionretirement income taxable to Idaho.

Additionally the states property and sales taxes are relatively low. Taxpayer is 62 years old or older and. Part 1 Age Disability and Filing.

When stationed outside the State of Idaho active duty personnel are exempt from Idaho state income tax. Civil Service Idahos firemens retirement fund or Policemans retirement compute the allowable deduction on ID Form 39R. Form 39NR Idaho Supplemental Schedule for Form 43 Nonresident and.

Exemptions exist for some federal state and local pensions as well as.

States That Won T Tax Your Retirement Distributions Income Tax Income Tax

States That Don T Tax Military Retirement Pay Discover Here

Senator Eyes Tax Exemption For Military Retirement Social Security Nebraska News Journalstar Com

Idaho Military And Veterans Benefits The Official Army Benefits Website

Are Military Retirements Exempt From Taxes

Military Retirement And Transition Services

State By State Guide To Taxes On Retirees Tax Retirement Retirement Income

8 Of The Best States For Military Retirees 2022 Edition Ahrn Com

Idaho State Veteran Benefits Military Com

States That Don T Tax Military Retirement Pay Discover Here

Bill Would Make Military Pensions Tax Exempt In Georgia Georgia Thecentersquare Com

State Tax Information For Military Members And Retirees Military Com

These Five States Just Eliminated Income Tax On Military Retirement

State Tax Information For Military Members And Retirees Military Com

States That Don T Tax Military Retirement Turbotax Tax Tips Videos

3 Myths About The New Military Retirement System Military Com

8 Of The Best States For Military Retirees 2022 Edition Ahrn Com